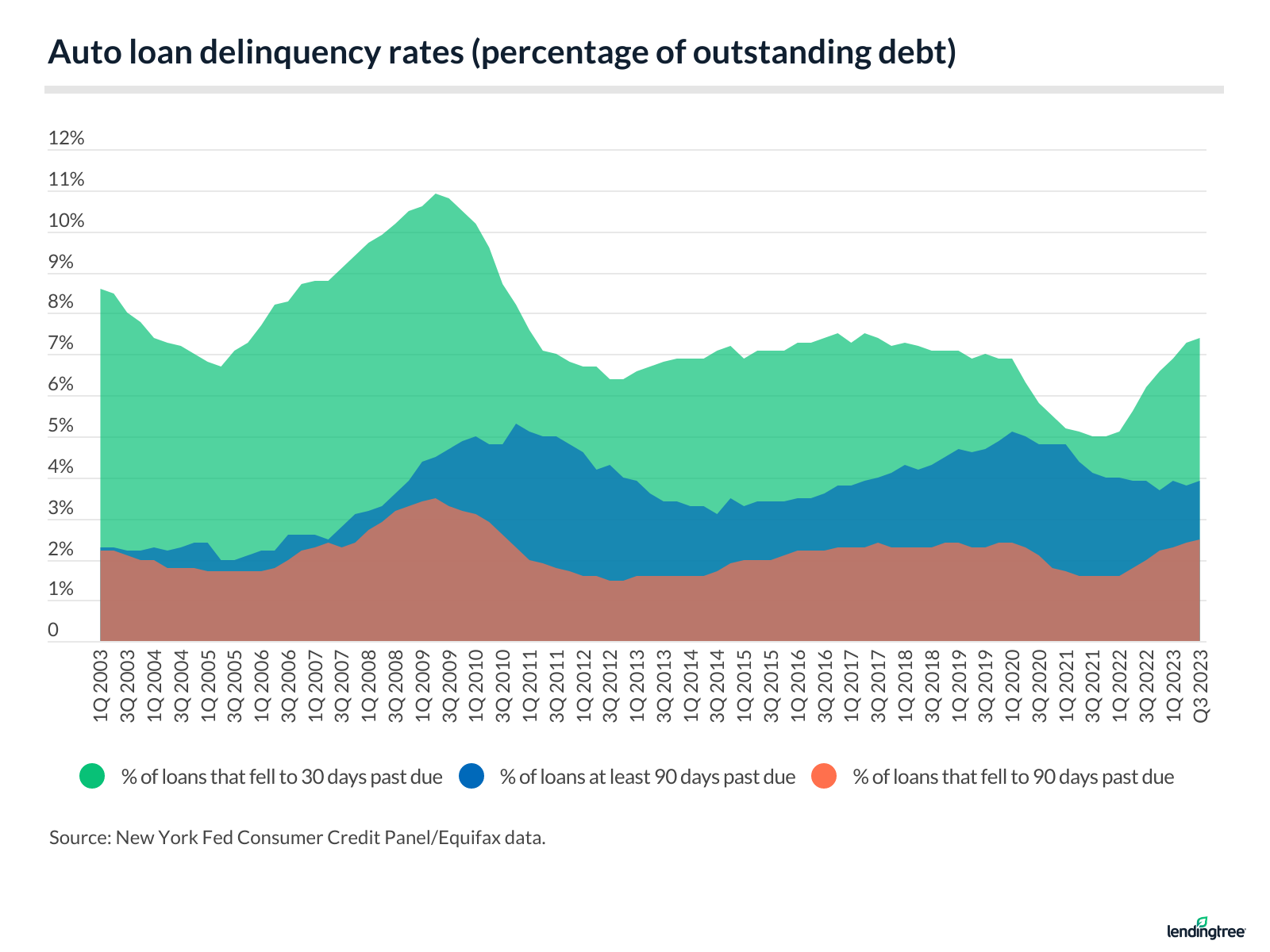

Auto Loan Delinquency Rates 2024. Aggregate delinquency rates increased in q4 2023, with 3.1% of outstanding debt in some stage of delinquency at the end of december. The delinquency rate trend, though elevated compared to 2021 and.

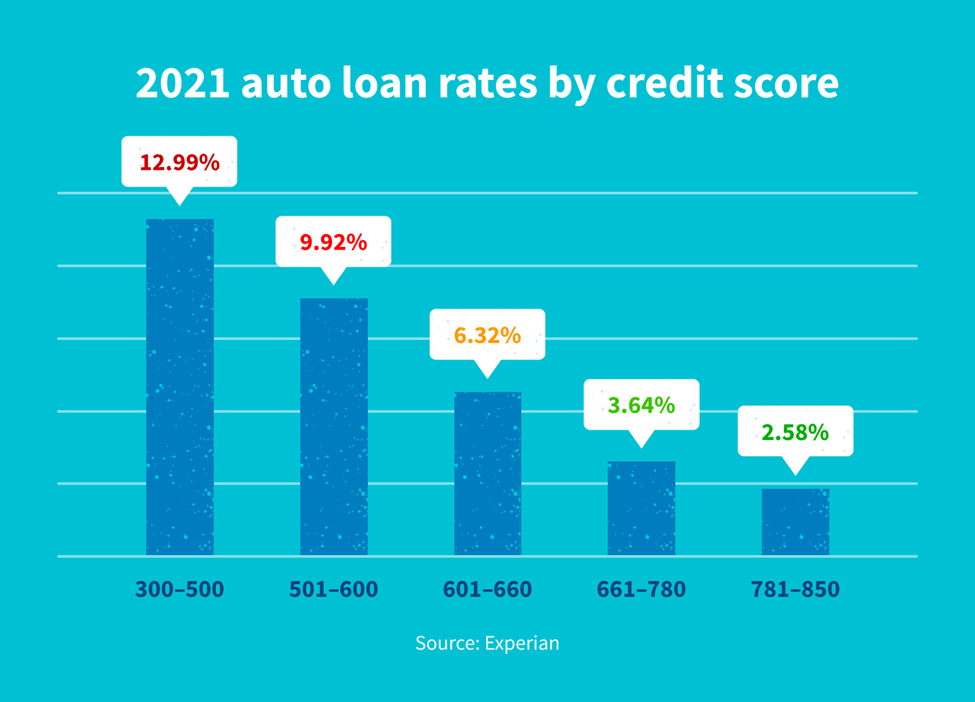

In the third quarter of 2023, the auto loan delinquency ratio jumped to 2.95% — up 20 basis points from the previous quarter and 56 basis points from the same time a. The average interest rate on a loan for a new car was 7.18 percent at the end of 2023, up from 6.08 percent in 2022, experian said.

For Example, Auto Loans Originated In 2021 Have A Delinquency Rate Of 0.67% In The Sixth Quarter After Origination, Which Is 13% Higher Than The Delinquency.

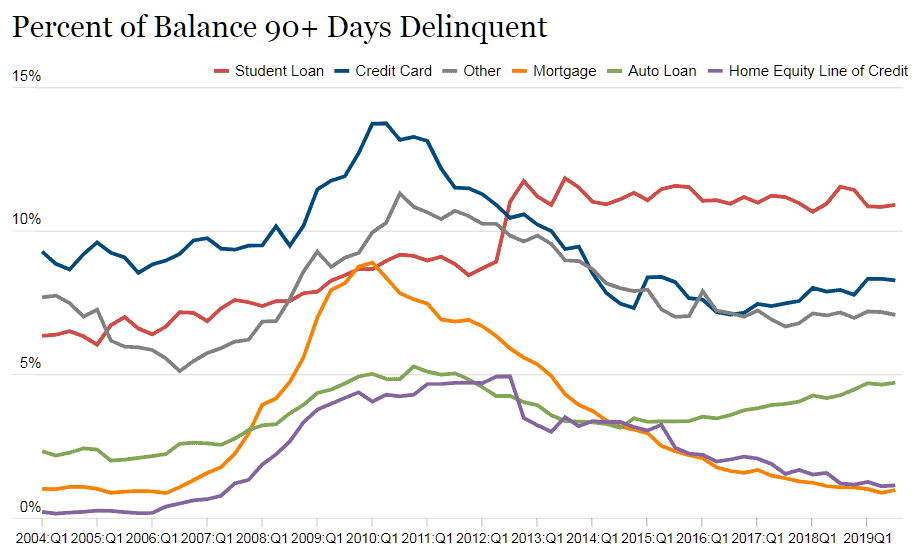

Delinquency rates increased for all debt.

But There Are Still Ways To Mitigate Your Risk.

Credit card, auto loan delinquency rates rise in ny fed report.

The Average Interest Rate On A Loan For A New Car Was 7.18 Percent At The End Of 2023, Up From 6.08 Percent In 2022, Experian Said.

Images References :

Source: defisolutions.com

Source: defisolutions.com

What You Need To Know About Auto Loan Delinquency Statistics, Auto loan rates for new vehicles in the us range from 4.75% to 13.42%, depending on credit scores and other factors. Credit cards and auto loans.

Source: www.lendingtree.com

Source: www.lendingtree.com

Average Car Payment and Auto Loan Statistics 2024 LendingTree, Credit cards and auto loans. Delinquency rates on credit cards and auto loans are the highest in more than a decade.

Source: www.autonews.com

Source: www.autonews.com

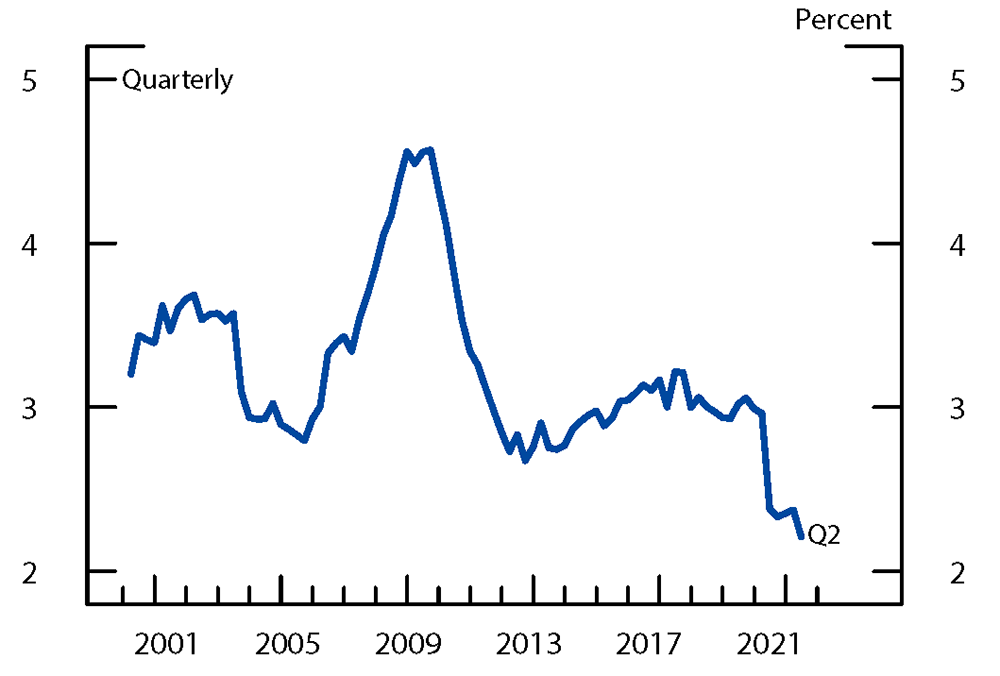

60day delinquency rates for auto loans drop in Q2 Automotive News, For example, auto loans originated in 2021 have a delinquency rate of 0.67% in the sixth quarter after origination, which is 13% higher than the delinquency. But there are still ways to mitigate your risk.

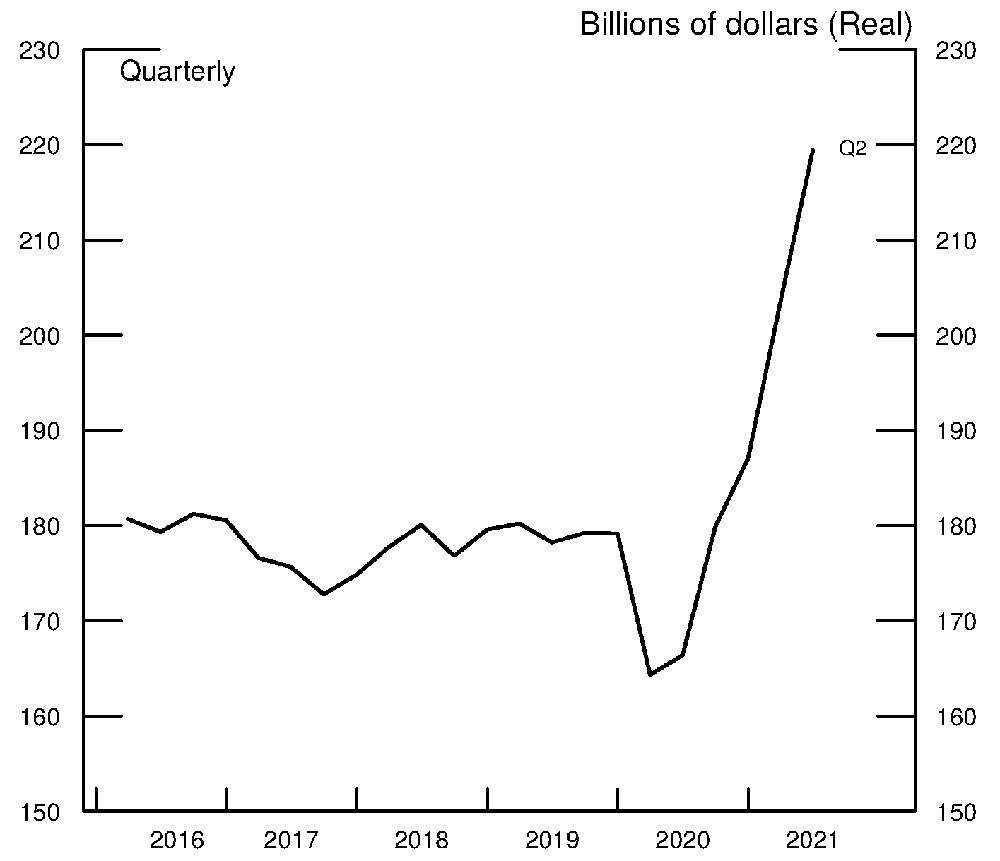

Source: www.federalreserve.gov

Source: www.federalreserve.gov

The Fed Delinquency Rates and the “Missing Originations” in the Auto, The average car payment for new vehicles was $726. This report does not constitute a rating action.

Source: defisolutions.com

Source: defisolutions.com

Auto Loan Delinquency Statistics 2020, The delinquency rate trend, though elevated compared to 2021 and. Auto loan rates for new vehicles in the us range from 4.75% to 13.42%, depending on credit scores and other factors.

Source: www.carnationcanadadirect.ca

Source: www.carnationcanadadirect.ca

Bad Credit Car Loan Approval Apply For Financing Online Today, Credit card balances increased by $50 billion. Credit card balances and delinquencies are up.

Source: www.creditrepair.com

Source: www.creditrepair.com

56 U.S. Auto Loan Statistics to Know in 2022, Recoveries improved month on month for the first time since may 2023 for both prime. Auto loan rates for new vehicles in the us range from 4.75% to 13.42%, depending on credit scores and other factors.

Source: www.federalreserve.gov

Source: www.federalreserve.gov

The Fed Delinquency Rates and the “Missing Originations” in the Auto, For consumers between the ages. In the third quarter of 2023, the auto loan delinquency ratio jumped to 2.95% — up 20 basis points from the previous quarter and 56 basis points from the same time a.

Source: www.spglobal.com

Source: www.spglobal.com

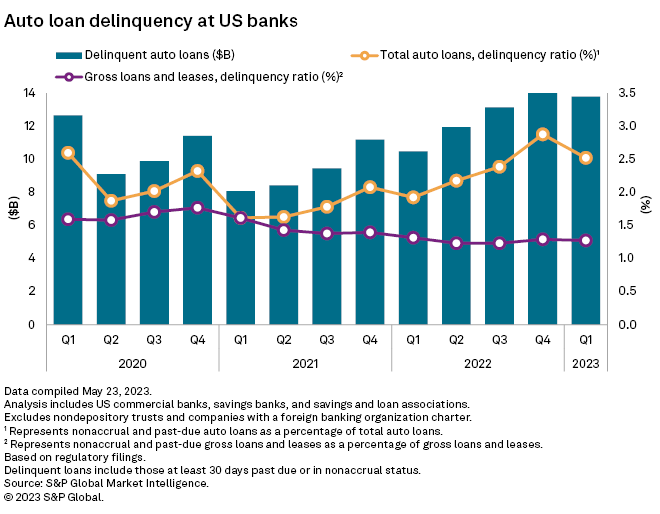

Auto loan delinquencies at US banks continue to rise on a yearover, Average car payment & auto loan statistics 2024: Some of those issues manifested in delinquency transition rates for all types of debt except student loans, which increased at the close of 2023, with 8.5% of credit.

Source: thefinancialbrand.com

Source: thefinancialbrand.com

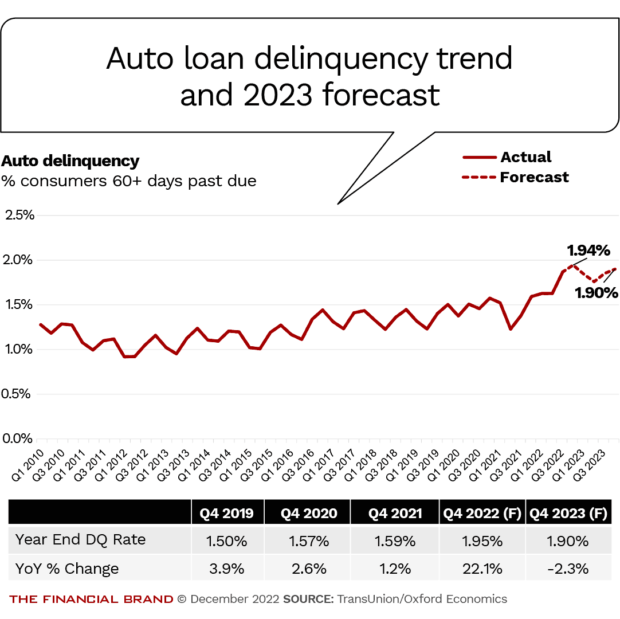

2023 Forecast Auto Lending Will Rev Up — But at a Price, Auto loan rates for new vehicles in the us range from 4.75% to 13.42%, depending on credit scores and other factors. Delinquency transition rates increased for all debt types, except for student loans.

Auto Loan Rates For New Vehicles In The Us Range From 4.75% To 13.42%, Depending On Credit Scores And Other Factors.

But there are still ways to mitigate your risk.

Delinquency Transition Rates Increased For All Debt Types, Except For Student Loans.

The average auto loan rate for a new car was 9.2% in december, and 13.8% for a used car loan according to auto market data company cox.